nh bonus tax calculator

And while New Hampshire doesnt collect income taxes you can still save on federal taxes. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year.

Tax Information Center Other Income H R Block

The calculator on this page uses the percentage method which calculates tax withholding based on the IRSs flat 22 tax rate on bonuses.

. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. New Hampshire Bonus Tax Aggregate Calculator Results. For 2022 New Hampshire unemployment insurance rates range from 01 to 85 with a taxable wage base of up to 14000 per employee per year.

Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. Another option is to put more of your paycheck into an HSA or FSA if your employer offers it. If you would like an estimate of what the property taxes will be please enter your property assessment in the field below.

The state has the right to adjust its rates quarterly so look out for notices to make sure you pay the right taxes each quarter. New Hampshire Income Tax Calculator 2021. You will need to.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. The percentage method and the aggregate method. There are two ways to calculate taxes on bonuses.

Rather than using a flat tax rate the bonus is added to regular wages to determine the additional taxes due. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. New Hampshire Bonus Tax Percent Calculator Results.

New employers should use 27. The aggregate method is more complicated and requires you to check out the tax rates listed on IRS Publication 15. NHgov privacy policy accessibility policy.

Besides the federal progressive tax bracket system there also exists the alternative minimum tax AMT system primarily for high income earners with alternative income streams. Below are your New Hampshire salary paycheck results. Use the New Hampshire bonus tax calculator to determine how much tax will be withheld from your bonus payment using the aggregate method.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income. The results are broken up into three sections. Your average tax rate is.

For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20. Federal Bonus Tax Percent Calculator. In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay.

From 170050 to 215950. Figure out your filing status. 27 responses to How Bonuses are Taxed Calculator Mr.

This calculator uses the Aggregate Method. At the time of receipt of your bonus federal taxes are typically withheld by your employer at a higher tax rate than your actual tax rate used when you file your taxes. So the tax year 2022 will start from July 01 2021 to June 30 2022.

The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value. While New Hampshire lacks a sales tax and personal income tax it does have some of the highest property taxes in the country. Your tax situation is complex.

This New Hampshire bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses. Calculating your New Hampshire state income tax is similar to the steps we listed on our Federal paycheck calculator. You have nonresident alien status.

See Publication 505 Tax Withholding and Estimated Tax. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. Estimate your tax withholding with the new Form W-4P.

While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends. January 24 2015 at 1202 pm. With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent.

Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. On average homeowners in New. And remember to pay your state unemployment.

One important difference with spending accounts and retirement accounts is that only 500 rolls over from year to year in an FSA. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. If you make 70000 a year living in the region of New Hampshire USA you will be taxed 11767.

From 215950 to 539900. Bonus Pay Calculator Tool. If your state does not have a special supplemental rate you will be forwarded to the aggregate bonus calculator.

The assessed value multiplied by the tax rate equals the annual real estate tax. Below are your New Hampshire salary paycheck results. New Hampshire levies special taxes on electricity use 000055 per kilowatt hour communications services 7 hotel rooms 9 and restaurant meals 9.

On average homeowners in New. New Hampshire Property Tax. This includes alternative minimum tax long-term capital gains or qualified dividends.

You might initially assume that if you have no major investments like stocks and bonds that. The results are broken up into three sections. This tax is only paid on income from these sources that is 2400 or more for single filers and 4800 or greater for joint filers.

This is state-by state compliant for those states who allow the. The Viventium Bonus Calculator uses your last paycheck amount to apply the correct withholding rates to special wage payments such as bonuses. This calculator is based upon the State of New Hampshires Department of Revenue.

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Tax Information Center Other Income H R Block

5 Must See Vintage Pinball Arcades Vintage Industrial Style

How Remote Work Affects Your Taxes And Deductions You May Qualify For Real Simple

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Which States Have The Lowest Property Taxes

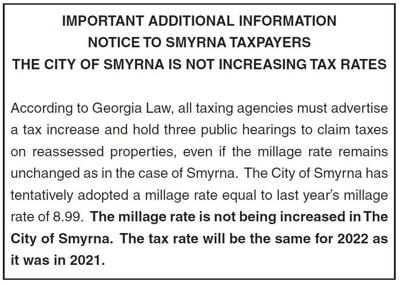

Our Opinion The Great Tax Millage Rate Ruse Local News Mdjonline Com

Deducting Cost Of A New Roof H R Block

2022 2023 Marginal Federal Tax Rate Calculator

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Remote Work Affects Your Taxes And Deductions You May Qualify For Real Simple

Mapped The Cost Of Health Insurance In Each Us State