monterey county property tax rate 2021

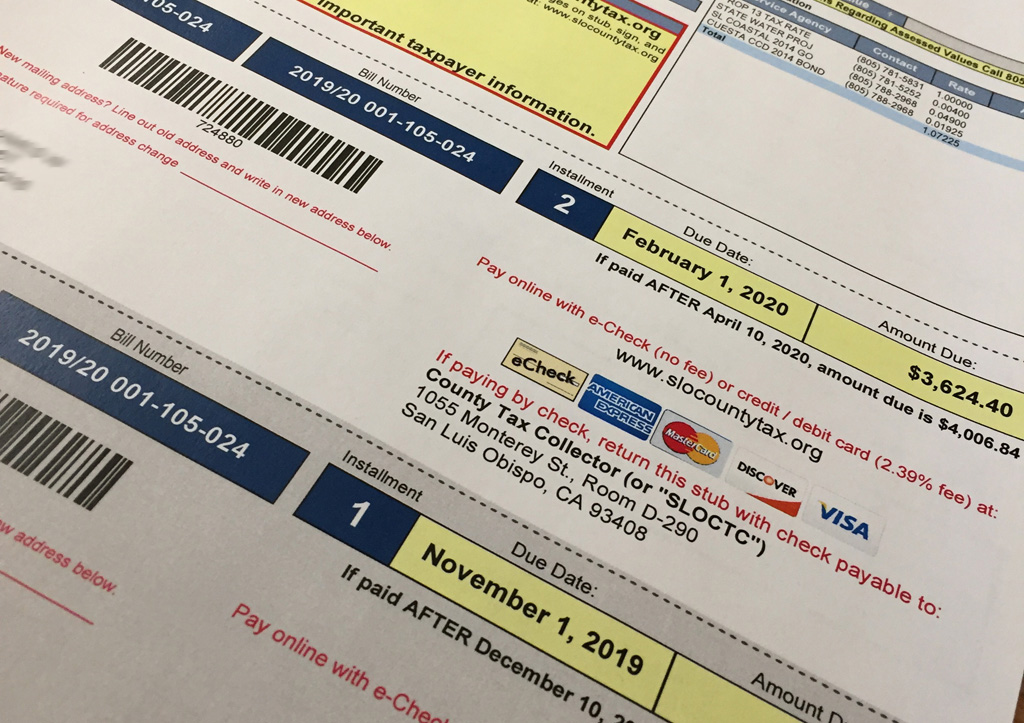

Welcome to the E-Filing process for Property Statements. Friday December 10 2021 Be sure to mail your tax payments postmarked by the United States Post Office on or before the December 10 2021 delinquent date in order to avoid a 10 penalty.

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

055 of home value.

. In 2021 the residential tax rate is 1093399 percent. District 4 - Wendy Root Askew. Yearly median tax in Monterey County.

July 2 Nov. A county-wide sales tax rate of 025 is applicable to localities in Monterey County in addition to the 6 California sales tax. Deadline for the Tax Collector to mail tax bills.

Tax amount varies by county. We invite you to our office for information and assistance. The median property tax in New Mexico is 88000 per year for a home worth the median value of 16090000.

Monterey County Treasurer - Tax Collectors Office. For credit cards the fee is 225 of the total amount you are paying. Certified Values By Tax Rate Area.

Counties in New Mexico collect an average of 055 of a propertys assesed fair market value as property tax per year. For more information please visit Monterey Countys Assessor Auditor and Treasurer - Tax Collector or look up this propertys. The California state sales tax rate is currently.

July 1 Oct. The TreasurerTax Collector serves the residents of Monterey County and public agencies by protecting the public trust through the delivery of valuable professional and innovative services in the collection of property taxes. This is the total of state and county sales tax rates.

When making a payment by mail please be sure to include your 12-digit ASMT number found on your tax bill. The deadline for payment of the first installment of 2021-2022 Monterey County Property Tax is. Download all California sales tax rates by zip code.

A county-wide sales tax rate of 025 is applicable to localities in Monterey County in addition to the 6 California sales tax. Counties in Nebraska collect an average of 176 of a propertys assesed fair market value as property tax per year. District 1 - Luis Alejo.

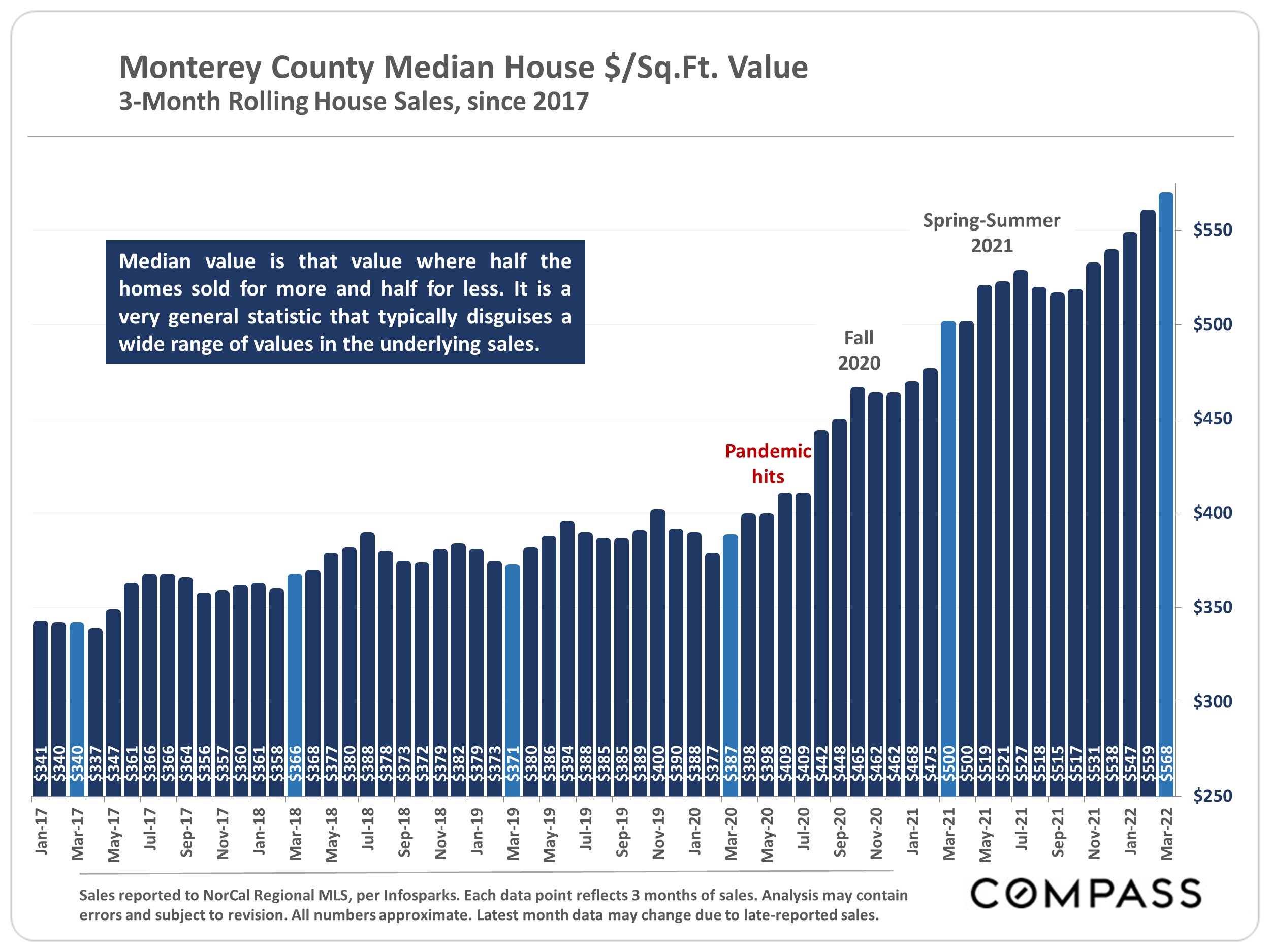

Payments can also be made by telephone. The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a median effective property tax rate of 051 of property value. Tax amount varies by county.

Period for filing claims for Senior Citizens Tax Assistance. District 5 - Mary Adams. Some cities and local governments in Monterey County collect additional local sales taxes which can be as high as 325.

All major cards MasterCard American Express Visa and Discover are accepted. The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales taxesThe local sales tax consists of a 025 county sales tax and a 150 special district sales tax used to fund transportation districts local attractions etc. Yes you can pay your property taxes by using a DebitCredit card.

Monterey County Tax Collector. Start filing your tax return now. Monterey County has one of the highest median property taxes in the United.

The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000. The median property value of homes in monterey county is 393300. The Monterey County sales tax rate is.

When you have completed the E-Filing process you should printsave a final copy of your Property Statement for your own records. The Consolidated Oversight Board for the County of Monterey was established in accordance with the California Health and Safety Code 34179j to oversee the activities. For E-Check a flat fee of 025 is charged.

Nebraska is ranked number seventeen out of the fifty states in. At any time prior to submitting the Statement for E-Filing you may printsave a draft copy for your review. This is the total of state and county sales tax rates.

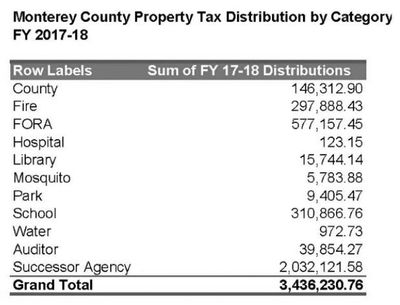

Where do Property Taxes Go. Monterey County collects on average 051 of a propertys assessed fair market value as property tax. You can learn much more about whom we are and the services we provide at this website.

Start of the Countys fiscal year. What is the sales tax rate in Monterey County. District 2 - John M.

Period during which County Board of Equalization accepts applications for appealing property values on regular assessment roll. 176 of home value. Hamilton County Property Tax Rate.

Paying Your Property Tax The Monterey County Tax Assessor can provide you with a copy of your property tax assessment show you your property tax bill help you pay your property taxes or arrange a payment plan. New Mexico has one of the lowest median property tax rates in. The Monterey County Sales Tax is 025.

Welcome to the Monterey County Department of Social Services DSS webpage. District 3 - Chris Lopez. Approximately 129000 parcels of property account for 838000000 fiscal year 2020-2021 in revenue for the County public schools cities and districts.

Monterey County collects relatively high property taxes and is ranked in the top half of all counties in the United States by property tax collections. Secured taxes make up the majority of monies collected by the Treasurer-Tax Collector. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non ad-valorem taxes levied as special taxes.

The sales tax jurisdiction name is Monterey Conference Center Facilities District which may refer to a local government division. Medina Director of Monterey County DSS 06032021. You can print a 925 sales tax table here.

At DSS we are committed to promoting a caring service community. Clerk of the Board. For more details about taxes in Monterey County.

The 2018 United States Supreme Court decision in South Dakota v. Checks should be made payable to. A convenience fee is charged for paying with a CreditDebit card.

For assistance in locating your ASMT number contact our office at 831 755-5057. The median property tax in Monterey County California is 2894 per year for a home worth the median value of 566300. 051 of home value.

2022 Property Statement E-Filing E-Filing Process. The 925 sales tax rate in Monterey consists of 6 California state sales tax 025 Monterey County sales tax 15 Monterey tax and 15 Special tax. The minimum combined 2022 sales tax rate for Monterey County California is.

Heres how Monterey Countys maximum sales tax rate of 95 compares to other.

Prop 218 Benefit Assessment North County Fire Protection District

Property Tax By County Property Tax Calculator Rethority

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Additional Property Tax Info Monterey County Ca

Monterey Peninsula Chamber Of Commerce Montereychamber Twitter

Regulated Cannabis Market To Expand In 2022 As More Municipalities Open Up Across California Law Offices Of Omar Figueroa

San Diego County Ca Property Tax Search And Records Propertyshark

First Installment Payments For 2019 20 Secured Property Tax Bills Are Due November 1st County Of San Luis Obispo

Monterey County Wines Subject To New Conjunctive Labeling Requirements Dpf Law

At A Glance Monterey County Monterey County Ca

The California Transfer Tax Who Pays What In Monterey County